资讯

微软不小心泄露收购邮件服务Acompli

google 推出inbox 之后,邮件服务就变得有趣起来了,大家都在找寻一些有趣的服务,Email 可能大家认为不过如此了,但是越来越多的新的APP出现,让这种假象打破了~

微软在未发布的博客中不小心透漏了这个消息: http://blogs.microsoft.com/blog/2014/11/25/microsoft-acquires-acompli/。

小编使用的就是Acompli ,为什么呢,因为可以收取Gmail 在国内!!

当然还很好用,这个不假,建议你可以试试!其联合创始人是JJ Zhuang (https://www.linkedin.com/in/jjzhuang)是中国人额!上海交大的校友!

在Acompli的官方网站称,该公司的宗旨是改善移动邮箱的体验,全面提升用户的工作效率,其认为和传统的PC端邮箱相比,移动优先还有很大的空白需要填补。

该公司总部位于旧金山,风险投资人中包括了红点资本、Felicis资本等。据报道,该公司之前已经融资了730万美元。

目前该公司的邮箱客户端已经推出了iOS和安卓版本,提供用户免费下载。该客户端可以管理用户的多个邮箱帐号。

复制去Google翻译翻译结果

https://www.linkedin.com/in/jjzhuang

资讯

【HRTechChina专稿】11月人力资源科技行业投融资小结

招聘平台新秀频起,11月份也不例外。在本月,人力资源科技行业也是喜报连连。从国内来讲,本月互联网招聘网站猎上网宣布获2000万美元的融资,而今年4月,猎上网才获IDG及华创资本千万美元投资。值得一提的是,与猎上网类似性质的猎聘网在今年四月也获得了C轮7000万美元融资。两家网站的发展都很迅速,但从另一方面看来,两者的市场跨张步伐也并不会进行得如此顺利了。两个网站都围绕猎头、简历等做服务,但在表现形式上也有又将刮起一场“血雨腥风”,我们希望招聘网站的“竞争”能给用户带来更为有利的产品和服务。大家以为如何?

值得一提的是,从融资情况来看,11月份国外的招聘类网站看似更为活跃。自由职业外包平台Elance-oDesk、利用大数据自动匹配公司内部人才与职位的Clustree、让科技创业公司这样的企业更加有效地招聘大学毕业生的“新人招聘市场”Tyba,纷纷获得千万美元的融资。招聘行业的机会看来还是很多的,且是一个硬的机会。但是以何种形式/模式来取胜,小编认为,这值得思考,也值得努力。

除此之外,企业应用、企业、团队的协作工具的发展也是越来越快,在本月,如,为企业团队提供任务跟踪、云存储及视频聊天等协作工具Redbooth、可以让员工们跨设备和平台(PC、安卓和iOS)沟通并分享文件的JANDI、又如国内的采用SAAS模式的、供企业外勤人员使用的移动办公工具、通过简单的协作、沟通和分享,实现团队交互与任务管理的团队协同办公工具Worktile 等也相继得到融资或者投资。盯上企业协作的人越来越多了,种类也越来越繁多,发展也越来越快,但这让原本处于发展初期但就竞争激烈的,尤其是国内中小团队轻协作市场比各自预期更快地加入洗牌和淘汰阶段。

2004年,自称是中国最大的,也是目前唯一拥有成熟的全国性营业员网络招聘服务平台的招聘网站。但58同城未公布交易金额和更多交易细节。据了解,58同城上市以后专门成立了投资部门,试图通过资本运作方式切入O2O的细分领域。

HRTECHCHINA独家整理

资讯

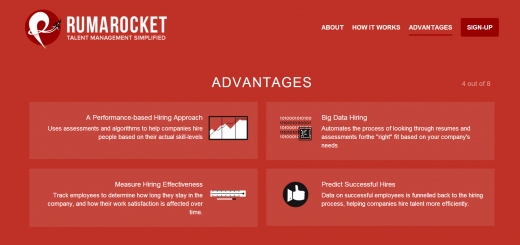

招聘行业多新秀:Rumarocket尝试通过数据学习帮助企业招募

Rumarocket 通过一系列已申请专利的自动化工具(机器学习算法)为公司优化招聘流程,节约时间和金钱。可以把 Rumorocket 想像成一个搜索引擎:总结个人表现数据、对雇员个人表现进行评估以及测评。雇主公司将更容易预测谁将是更适合公司的最佳员工。

其优势自己总结为:

A Performance-based Hiring Approach

Uses assessments and algorithms to help companies hire people based on their actual skill-levels

Big Data Hiring

Automates the process of looking through resumes and assessments for

the "right" fit based on your company's needs

Measure Hiring Effectiveness

Track employees to determine how long they stay in the company, and how their work satisfaction is affected over time.

Predict Successful Hires

Data on successful employees is funnelled back to the hiring process, helping companies hire talent more efficiently.

目前该网站还未正式上线

http://rumarocket.com/

复制去Google翻译翻译结果

优势

资讯

WORKDAY预计2016年营收低於市场预估,早盘股价下挫

路透11月25日 - 人力资源软件生产商WORKDAY (WDAY.N) 预计,2016会计年度营收低於市场预估;另外第四季营收预估暗示,在截至明年1月的本会计年度,营收将大约增长66-67%,远低於2014会计年度增长的71%。

包括高盛在内的至少六家券商,将WORKDAY目标价预估最多下调10美元,至90美元,目标价预估中值为100美元。

在周二早盘交易中,WORKDAY股价下挫4.9%,报87.87美元,最新市值162亿美金。

附录:

Workday Announces Fiscal 2015 Third Quarter Financial Results

PLEASANTON, CA--(Marketwired - Nov 24, 2014) - Workday, Inc. (NYSE: WDAY), a leader in enterprise cloud applications for finance and human resources, today announced results for the fiscal third quarter ended October 31, 2014.

Total revenues were $215.1 million, an increase of 68% from the third quarter of fiscal 2014. Subscription revenues were $164.4 million, an increase of 75% from same period last year.

Operating loss was $51.5 million, or negative 23.9% of revenues, compared to an operating loss of $40.4 million, or negative 31.6% of revenues, in the same period last year. Non-GAAP operating loss for the third quarter was $2.9 million, or negative 1.4% of revenues, compared to a non-GAAP operating loss of $19.9 million last year, or negative 15.6% of revenues.1

Net loss per basic and diluted share was $0.33, compared to a net loss per basic and diluted share of $0.27 in the third quarter of fiscal 2014. The non-GAAP net loss per basic and diluted share for the third quarter was $0.03, compared to a non-GAAP net loss per basic and diluted share of $0.12 during the same period last year.1

Operating cash flows for the third quarter were $41.0 million and free cash flows were $13.3 million. For the trailing twelve months, operating cash flows were $88.5 million and free cash flows were a negative $4.8 million.2

Cash, cash equivalents and marketable securities were approximately $1.8 billion as of October 31, 2014. Unearned revenue was $508.1 million, a 44% increase from last year.

"We had a strong third quarter and saw increasing customer demand globally," said Aneel Bhusri, co-founder and CEO, Workday. "We also welcomed a record number of customers to our eighth annual customer conference, Workday Rising, where we announced our newest suite of applications, Workday Insight Applications, to deepen the value our customers gain with one system in the cloud for finance and human resources."

"We are very pleased with our solid third quarter results," said Mark Peek, chief financial officer, Workday. "We generated record quarterly revenues and trailing twelve month operating cash flows. Looking ahead, we anticipate fourth quarter total revenues to be within a range of $219 and $222 million, or growth of 54% to 56% as compared to the prior year."

Recent Highlights

Workday held its eighth annual customer conference, Workday Rising, bringing together more than 4,500 members of the Workday community for education and collaboration in San Francisco.

Workday introduced Workday Insight Applications, a new suite of applications that will use the power of advanced data science and machine learning algorithms to help customers make smarter financial and workforce decisions. Workday is scheduled to make select Workday Insight Applications generally available to customers in calendar year 2015.

Workday Financial Management momentum continued as the company surpassed the 100-customer milestone. Additionally, in its latest feature release, Workday 23, Workday unveiled Composite Reporting, an advanced reporting tool, as well as industry-specific functionality to further address the finance needs of large organizations.

Workday plans to host a conference call today to review its third quarter financial results and to discuss its financial outlook. The call is scheduled to begin at 2:00 p.m. PT/ 5:00 p.m. ET and can be accessed via webcast or through the company's Investor Relations website atwww.workday.com/investorrelations. The webcast will be available live, and a replay will be available following completion of the live broadcast for approximately 45 days.

1 Non-GAAP operating loss and net loss per share for the fiscal third quarters of 2015 and 2014 exclude share-based compensation, employer payroll taxes on employee stock transactions and debt discount and issuance costs associated with convertible notes, and for the fiscal third quarter of 2015, also exclude amortization expense for acquisition-related intangible assets. See the section titled "About Non-GAAP Financial Measures" in the accompanying financial tables for further details.

2 Free cash flows are defined as operating cash flows minus capital expenditures, assets acquired under a capital lease and purchased other intangible assets. See the section titled "About Non-GAAP Financial Measures" in the accompanying financial tables for further details.

About Workday

Workday is a leading provider of enterprise cloud applications for finance and human resources. Founded in 2005, Workday delivers financial management, human capital management, and analytics applications designed for the world's largest companies, educational institutions, and government agencies. Hundreds of organizations, ranging from medium-sized businesses to Fortune 50 enterprises, have selected Workday.

Use of Non-GAAP Financial Measures

Reconciliations of non-GAAP financial measures to Workday's financial results as determined in accordance with GAAP are included at the end of this press release following the accompanying financial data. For a description of these non-GAAP financial measures, including the reasons management uses each measure, please see the section of the tables titled "About Non-GAAP Financial Measures."

Forward-Looking Statements

This press release contains forward-looking statements including, among other things, statements regarding Workday's fourth quarter revenue projections. The words "believe," "may," "will," "estimate," "continue," "anticipate," "intend," "expect," and similar expressions are intended to identify forward-looking statements. These forward-looking statements are subject to risks, uncertainties, and assumptions. If the risks materialize or assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. Risks include, but are not limited to: (i) breaches in our security measures, unauthorized access to our customers' data or disruptions in our data center operations; (ii) our ability to manage our growth effectively; (iii) competitive factors, including but not limited to pricing pressures, industry consolidation, entry of new competitors and new applications and marketing initiatives by our competitors; (iv) the development of the market for enterprise cloud services; (v) acceptance of our applications and services by customers; (vi) adverse changes in general economic or market conditions; (vii) delays or reductions in information technology spending; (viii) our limited operating history, which makes it difficult to predict future results; and (ix) changes in sales may not be immediately reflected in our results due to our subscription model. Further information on risks that could affect Workday's results is included in our filings with the Securities and Exchange Commission (SEC), including our Form 10-Q for the quarter ended July 31, 2014 and our future reports that we may file with the SEC from time to time, which could cause actual results to vary from expectations. Workday assumes no obligation to, and does not currently intend to, update any such forward-looking statements after the date of this release.

Any unreleased services, features, or functions referenced in this document, our website or other press releases or public statements that are not currently available are subject to change at Workday's discretion and may not be delivered as planned or at all. Customers who purchase Workday services should make their purchase decisions based upon services, features, and functions that are currently available.

© 2014. Workday, Inc. All rights reserved. Workday and the Workday logo are registered trademarks of Workday, Inc. All other brand and product names are trademarks or registered trademarks of their respective holders.

Workday, Inc.

Condensed Consolidated Balance Sheets

(in thousands)

(unaudited)

October 31,

2014

January 31,

2014(1)

Assets

Current assets:

Cash and cash equivalents

$

192,142

$

581,326

Marketable securities

1,642,517

1,305,253

Accounts receivable, net

118,943

92,184

Deferred costs

19,024

16,446

Prepaid expenses and other current assets

37,120

28,449

Total current assets

2,009,746

2,023,658

Property and equipment, net

116,640

77,664

Deferred costs, noncurrent

18,342

20,797

Goodwill and acquisition-related intangible assets, net

35,079

8,488

Other assets

52,511

45,658

Total assets

$

2,232,318

$

2,176,265

Liabilities and stockholders' equity

Current liabilities:

Accounts payable

$

9,610

$

6,212

Accrued expenses and other current liabilities

34,508

17,999

Accrued compensation

47,510

55,620

Capital leases

4,681

9,377

Unearned revenue

441,324

332,682

Total current liabilities

537,633

421,890

Convertible senior notes, net

484,855

468,412

Capital leases, noncurrent

--

3,589

Unearned revenue, noncurrent

66,807

80,883

Other liabilities

13,807

14,274

Total liabilities

1,103,102

989,048

Stockholders' equity:

Common stock

185

181

Additional paid-in capital

1,891,872

1,761,156

Accumulated other comprehensive income

64

269

Accumulated deficit

(762,905

)

(574,389

)

Total stockholders' equity

1,129,216

1,187,217

Total liabilities and stockholders' equity

$

2,232,318

$

2,176,265

(1)

Amounts as of January 31, 2014 were derived from the January 31, 2014 audited financial statements.

Workday, Inc.

Condensed Consolidated Statements of Operations

(in thousands, except per share data)

(unaudited)

Three Months Ended

October 31,

Nine Months Ended

October 31,

2014

2013

2014

2013

Revenues:

Subscription services

$

164,403

$

93,925

$

431,462

$

243,454

Professional services

50,667

33,947

130,125

83,618

Total revenues

215,070

127,872

561,587

327,072

Costs and expenses(1):

Costs of subscription services

27,426

18,076

73,258

49,333

Costs of professional services

44,363

30,515

121,590

76,711

Product development

85,270

49,349

227,905

126,799

Sales and marketing

80,681

54,051

227,371

136,565

General and administrative

28,796

16,280

76,781

42,970

Total costs and expenses

266,536

168,271

726,905

432,378

Operating loss

(51,466

)

(40,399

)

(165,318

)

(105,306

)

Other expense, net

(8,047

)

(6,893

)

(21,999

)

(10,628

)

Loss before provision for income taxes

(59,513

)

(47,292

)

(187,317

)

(115,934

)

Provision for income taxes

399

242

1,199

593

Net loss

$

(59,912

)

$

(47,534

)

$

(188,516

)

$

(116,527

)

Net loss per share, basic and diluted

$

(0.33

)

$

(0.27

)

$

(1.03

)

$

(0.68

)

Weighted-average shares used to compute net loss per share, basic and diluted

184,310

174,385

182,770

171,269

(1) Costs and expenses include share-based compensation as follows:

Costs of subscription services

$

1,959

$

783

$

4,622

$

1,446

Costs of professional services

4,214

1,559

9,931

2,835

Product development

19,191

7,032

46,796

12,404

Sales and marketing

8,678

4,583

22,807

7,431

General and administrative

12,966

5,726

32,508

12,766

Workday, Inc.

Condensed Consolidated Statements of Cash Flows

(in thousands)

(unaudited)

Three Months Ended

October 31,

Nine Months Ended

October 31,

2014

2013

2014

2013

Cash flows from operating activities

Net loss

$

(59,912

)

$

(47,534

)

$

(188,516

)

$

(116,527

)

Adjustments to reconcile net loss to net cash provided by operating activities:

Depreciation and amortization

15,682

9,361

42,679

23,981

Share-based compensation expenses

47,008

19,683

116,664

36,882

Amortization of deferred costs

5,740

3,211

14,113

8,449

Amortization of debt discount and issuance costs

6,083

5,764

18,005

8,554

Other

1,808

86

2,654

256

Changes in operating assets and liabilities, net of business combinations:

Accounts receivable

(18,598

)

(19,997

)

(27,052

)

(19,674

)

Deferred costs

(4,340

)

(5,346

)

(14,236

)

(12,449

)

Prepaid expenses and other assets

1,586

(2,652

)

(8,512

)

(12,794

)

Accounts payable

4,056

1,891

1,603

5,563

Accrued expense and other liabilities

15,271

16,458

1,760

22,720

Unearned revenue

26,658

26,151

94,566

66,509

Net cash provided by operating activities

41,042

7,076

53,728

11,470

Cash flows from investing activities

Purchases of marketable securities

(454,219

)

(499,787

)

(1,490,404

)

(1,229,488

)

Maturities of marketable securities

368,984

256,240

1,136,456

833,107

Sales of available-for-sale securities

--

--

8,138

--

Business combinations, net of cash acquired

--

--

(26,317

)

--

Purchases of property and equipment

(27,699

)

(16,757

)

(65,981

)

(48,384

)

Purchase of cost method investment

--

--

(10,000

)

--

Other

--

--

1,000

90

Net cash (used in) investing activities

(112,934

)

(260,304

)

(447,108

)

(444,675

)

Cash flows from financing activities

Proceeds from borrowings on convertible senior notes, net of issuance costs

--

--

--

584,291

Proceeds from issuance of warrants

--

--

--

92,708

Purchase of convertible senior notes hedges

--

--

--

(143,729

)

Proceeds from issuance of common stock from employee equity plans

2,615

2,637

20,780

9,312

Principal payments on capital lease obligations

(1,123

)

(2,817

)

(8,285

)

(9,505

)

Shares repurchased for tax withholdings on vesting of restricted stock

--

(637

)

(8,291

)

(637

)

Other

91

41

151

121

Net cash provided by (used in) financing activities

1,583

(776

)

4,355

532,561

Effect of exchange rate changes

(183

)

32

(159

)

(54

)

Net increase (decrease) in cash and cash equivalents

(70,492

)

(253,972

)

(389,184

)

99,302

Cash and cash equivalents at the beginning of period

262,634

437,432

581,326

84,158

Cash and cash equivalents at the end of period

$

192,142

$

183,460

$

192,142

$

183,460

Workday, Inc.

Reconciliation of GAAP to Non-GAAP Data

Three Months Ended October 31, 2014

(in thousands, except per share data)

(unaudited)

GAAP

Share-Based

Compensation

Other

Operating

Expenses(2)

Amortization

of Debt

Discount and

Issuance Costs

Non-GAAP

Costs and expenses:

Costs of subscription services

$

27,426

$

(1,959

)

$

(13

)

$

--

$

25,454

Costs of professional services

44,363

(4,214

)

(69

)

--

40,080

Product development

85,270

(19,191

)

(628

)

--

65,451

Sales and marketing

80,681

(8,678

)

(485

)

--

71,518

General and administrative

28,796

(12,966

)

(330

)

--

15,500

Operating loss

(51,466

)

47,008

1,525

--

(2,933

)

Operating margin

(23.9

)%

21.9

%

0.6

%

--

(1.4

)%

Other expense, net

(8,047

)

--

--

6,083

(1,964

)

Loss before provision for income taxes

(59,513

)

47,008

1,525

6,083

(4,897

)

Provision for income taxes

399

--

--

--

399

Net loss

$

(59,912

)

$

47,008

$

1,525

$

6,083

$

(5,296

)

Net loss per share, basic and diluted (1)

$

(0.33

)

$

0.26

$

0.01

$

0.03

$

(0.03

)

(1)

Calculated based upon 184,310 basic and diluted weighted-average shares of common stock.

(2)

Other operating expenses include employer payroll taxes on employee stock transactions and amortization of acquisition-related intangible assets.

Workday, Inc.

Reconciliation of GAAP to Non-GAAP Data

Three Months Ended October 31, 2013

(in thousands, except per share data)

(unaudited)

GAAP

Share-Based

Compensation

Other

Operating

Expenses(2)

Amortization

of Debt

Discount and

Issuance Costs

Non-GAAP

Costs and expenses:

Costs of subscription services

$

18,076

$

(783

)

$

--

$

--

$

17,293

Costs of professional services

30,515

(1,559

)

(164

)

--

28,792

Product development

49,349

(7,032

)

(390

)

--

41,927

Sales and marketing

54,051

(4,583

)

(87

)

--

49,381

General and administrative

16,280

(5,726

)

(188

)

--

10,366

Operating loss

(40,399

)

19,683

829

--

(19,887

)

Operating margin

(31.6

)%

15.4

%

0.6

%

--

(15.6

)%

Other expense, net

(6,893

)

--

--

5,764

(1,129

)

Loss before provision for income taxes

(47,292

)

19,683

829

5,764

(21,016

)

Provision for income taxes

242

--

--

--

242

Net loss

$

(47,534

)

$

19,683

$

829

$

5,764

$

(21,258

)

Net loss per share, basic and diluted (1)

$

(0.27

)

$

0.11

$

--

$

0.04

$

(0.12

)

(1)

Calculated based upon 174,385 basic and diluted weighted-average shares of common stock.

(2)

Other operating expenses include employer payroll taxes on employee stock transactions.

Workday, Inc.

Reconciliation of GAAP to Non-GAAP Data

Nine Months Ended October 31, 2014

(in thousands, except per share data)

(unaudited)

GAAP

Share-Based

Compensation

Other

Operating

Expenses(2)

Amortization

of Debt

Discount and

Issuance Costs

Non-GAAP

Costs and expenses:

Costs of subscription services

$

73,258

$

(4,622

)

$

(101

)

$

--

$

68,535

Costs of professional services

121,590

(9,931

)

(204

)

--

111,455

Product development

227,905

(46,796

)

(2,098

)

--

179,011

Sales and marketing

227,371

(22,807

)

(996

)

--

203,568

General and administrative

76,781

(32,508

)

(688

)

--

43,585

Operating loss

(165,318

)

116,664

4,087

--

(44,567

)

Operating margin

(29.4

)%

20.8

%

0.7

%

--

(7.9

)%

Other expense, net

(21,999

)

--

--

18,005

(3,994

)

Loss before provision for income taxes

(187,317

)

116,664

4,087

18,005

(48,561

)

Provision for income taxes

1,199

--

--

--

1,199

Net loss

$

(188,516

)

$

116,664

$

4,087

$

18,005

$

(49,760

)

Net loss per share, basic and diluted (1)

$

(1.03

)

$

0.64

$

0.02

$

0.10

$

(0.27

)

(1)

Calculated based upon 182,770 basic and diluted weighted-average shares of common stock.

(2)

Other operating expenses include employer payroll taxes on employee stock transactions and amortization of acquisition-related intangible assets.

Workday, Inc.

Reconciliation of GAAP to Non-GAAP Data

Nine Months Ended October 31, 2013

(in thousands, except per share data)

(unaudited)

GAAP

Share-Based

Compensation

Other

Operating

Expenses(2)

Amortization

of Debt

Discount and

Issuance Costs

Non-GAAP

Costs and expenses:

Costs of subscription services

$

49,333

$

(1,446

)

$

(8

)

$

--

$

47,879

Costs of professional services

76,711

(2,835

)

(511

)

--

73,365

Product development

126,799

(12,404

)

(940

)

--

113,455

Sales and marketing

136,565

(7,431

)

(470

)

--

128,664

General and administrative

42,970

(12,766

)

(413

)

--

29,791

Operating loss

(105,306

)

36,882

2,342

--

(66,082

)

Operating margin

(32.2

)%

11.3

%

0.7

%

--

(20.2

)%

Other expense, net

(10,628

)

--

--

8,554

(2,074

)

Loss before provision for income taxes

(115,934

)

36,882

2,342

8,554

(68,156

)

Provision for income taxes

593

--

--

--

593

Net loss

$

(116,527

)

$

36,882

$

2,342

$

8,554

$

(68,749

)

Net loss per share, basic and diluted (1)

$

(0.68

)

$

0.22

$

0.01

$

0.05

$

(0.40

)

(1)

Calculated based upon 171,269 basic and diluted weighted-average shares of common stock.

(2)

Other operating expenses include employer payroll taxes on employee stock transactions.

Workday, Inc.

Reconciliation of GAAP Cash Flows from Operations to Free Cash Flows

(A Non-GAAP Financial Measure)

(in thousands)

(unaudited)

Three Months Ended

October 31,

Nine Months Ended

October 31,

2014

2013

2014

2013

GAAP cash flows from operating activities

$

41,042

$

7,076

$

53,728

$

11,470

Capital expenditures

(27,699

)

(16,757

)

(65,981

)

(48,384

)

Property and equipment acquired under capital lease

--

--

--

(115

)

Free cash flows

$

13,343

$

(9,681

)

$

(12,253

)

$

(37,029

)

Trailing Twelve Months Ended

October 31,

2014

2013

GAAP cash flows from operating activities

$

88,521

$

17,410

Capital expenditures

(78,322

)

(57,479

)

Property and equipment acquired under capital lease

--

(945

)

Purchase of other intangible assets

(15,000

)

--

Free cash flows

$

(4,801

)

$

(41,014

)

About Non-GAAP Financial Measures

To provide investors and others with additional information regarding Workday's results, we have disclosed the following non-GAAP financial measures: non-GAAP operating loss, non-GAAP net loss per share and free cash flows. Workday has provided a reconciliation of each non-GAAP financial measure used in this earnings release to the most directly comparable GAAP financial measure. The non-GAAP financial measures non-GAAP operating loss and non-GAAP net loss per share differ from GAAP in that they exclude share-based compensation, employer payroll taxes on employee stock transactions, amortization of acquisition-related intangible assets and non-cash interest expense related to our convertible senior notes, as applicable. Free cash flows differ from GAAP cash flows from operating activities in that it treats capital expenditures, assets acquired under a capital lease and purchased other (non-acquisition related) intangible assets as a reduction to cash flows.

Workday's management uses these non-GAAP financial measures to understand and compare operating results across accounting periods, and for internal budgeting and forecasting purposes, for short- and long-term operating plans, and to evaluate Workday's financial performance and the ability of operations to generate cash. Management believes these non-GAAP financial measures reflect Workday's ongoing business in a manner that allows for meaningful period-to-period comparisons and analysis of trends in Workday's business, as they exclude expenses that are not reflective of ongoing operating results. Management also believes that these non-GAAP financial measures provide useful information to investors and others in understanding and evaluating Workday's operating results and future prospects in the same manner as management and in comparing financial results across accounting periods and to those of peer companies. Additionally, management believes information regarding free cash flows provides investors and others with an important perspective on the cash available to make strategic acquisitions and investments, to fund ongoing operations and to fund other capital expenditures.

Management believes excluding the following items from the most directly comparable GAAP measures is useful to investors and others in assessing Workday's operating performance due to the following factors:

Share-based compensation. Although share-based compensation is an important aspect of the compensation of our employees and executives, management believes it is useful to exclude share-based compensation in order to better understand the long-term performance of our core business and to facilitate comparison of our results to those of peer companies. For restricted share awards, the amount of share-based compensation expenses is not reflective of the value ultimately received by the grant recipients. Moreover, determining the fair value of certain of the share-based instruments we utilize involves a high degree of judgment and estimation and the expense recorded may bear little resemblance to the actual value realized upon the vesting or future exercise of the related share-based awards. Unlike cash compensation, the value of stock options and the Employee Stock Purchase Plan, which is an element of our ongoing share-based compensation expenses, is determined using a complex formula that incorporates factors, such as market volatility and forfeiture rates, that are beyond our control.

Other Operating Expenses. Other operating expenses included employer payroll taxes on employee stock transactions for the three and nine months ended October 31, 2014 and 2013 and amortization of acquisition-related intangible assets for the three and nine months ended October 31, 2014. The amount of employer payroll taxes on share-based compensation is dependent on our stock price and other factors that are beyond our control and do not correlate to the operation of the business. For business combinations, we generally allocate a portion of the purchase price to intangible assets. The amount of the allocation is based on estimates and assumptions made by management and is subject to amortization. The amount of purchase price allocated to intangible assets and the term of its related amortization can vary significantly and are unique to each acquisition and thus we do not believe it is reflective of the ongoing operations.

Amortization of debt discount and issuance costs. Under GAAP, we are required to separately account for liability (debt) and equity (conversion option) components of the convertible senior notes that were issued in private placements in June 2013. Accordingly, for GAAP purposes we are required to recognize the effective interest expense on our convertible senior notes and amortize the issuance costs over the term of the notes. The difference between the effective interest expense and the contractual interest expense and the amortization expense of issuance costs are excluded from management's assessment of our operating performance because management believes that these non-cash expenses are not indicative of ongoing operating performance. Management believes that the exclusion of the non-cash interest expense provides investors an enhanced view of the company's operational performance.

Additionally, we believe that the non-GAAP financial measure, free cash flows, is meaningful to investors because we review cash flows generated from or used in operations after deducting capital expenditures, whether purchased or leased, and purchased other intangible assets, due to the fact that these expenditures are considered to be an ongoing operational component of our business. This provides an enhanced view of cash available to make strategic acquisitions and investments, to fund ongoing operations and to fund other capital expenditures.

The use of non-GAAP operating loss and net loss per share has certain limitations as they do not reflect all items of income and expense that affect Workday's operations. Workday compensates for these limitations by reconciling the non-GAAP financial measures to the most comparable GAAP financial measures. These non-GAAP financial measures should be considered in addition to, not as a substitute for or in isolation from, measures prepared in accordance with GAAP. Further, these non-GAAP measures may differ from the non-GAAP information used by other companies, including peer companies, and therefore comparability may be limited. Management encourages investors and others to review Workday's financial information in its entirety and not rely on a single financial measure.

Contact:

Investor Relations

Michael Haase

(925) 951-9005

Michael.Haase@Workday.com

Media

Eric Glass

(415) 432-3056

Eric.Glass@Workday.com

复制去Google翻译翻译结果

资讯

HR,莫被社交化绑架

大道至简,回归本质。社交化时代来了,员工个人的价值和声音在放大,面对员工个性化诉求,HR是迎合、追随,还是牵引?最有效的方法可能是最简单的——回归本质,遵从人性、人心。

互联网发展滚滚向前,人力资源管理已呈现社交化倾向。何为人力资源管理社交化?狭义地讲,是以企业人力资源部门为最小单元或载体的强关系网络为基础,对内解决企业内部组织与人之间的互动、人与人之间的互信关系等问题,对外则是解决加强外界与企业人力资源的有效沟通、与第三方伙伴之间高效协同、信息共享等问题。

HR,莫被社交化绑架

互联网发展滚滚向前,人力资源管理已呈现社交化倾向

一句话,与传统的重规则、讲流程、层级化的人力资源管理不同,社交化的新式管理更强调个性化、互动性、即时性,以新媒体为载体,体现的是所有人对所有人的沟通。

社交化挑战面面观

原来的人才基本封闭在企业内部,是属于“企业”的,而今人才则更趋社会化,是属于“社会”的,人才流动趋势明显。比如,人才会在各种社交网络、圈子活动中留下自己的足迹,特别是企业实名认证后的管理人员、技术人员,更容易被猎头公司、竞争对手获取联络方式,或者通过“关键字”等手段精准跟踪、定向捕获,人才被动流失风险加大。

同时,借助社交网络的便捷性,人才行为更趋市场化,人才自身会更关注同行业、竞争对手的发展变化,比如很容易通过微博、微信直接跟其他企业的老板、创始人对话,绕开猎头机构、企业HR。一旦对方老板发出邀约,明确给出一个更利于人才发展的职业机会,人才跳槽成本降低,风险相对可控,自动跳槽意愿自然加大。

而随着社交化大势所趋,因客户在社交化,企业会更加关注客户体验、客户个性化的需求,而客户群的消费习惯、行为模式存在较大不确定性,这势必对企业业务模式、后台管理、组织架构产生直接影响。而人力资源部门所对应的组织架构设计、业务流程梳理、岗位职责定义都要直接响应,这也就意味着,人力资源现有的组织规划、岗位设置、人员编制、人工成本等工作都要动态化、市场化,这对人力资源传统条块的管理挑战不小。

社交化也让组织内部沟通模式发生变化。以往组织的边界清晰、有严谨的架构;可在社交化习惯影响下,员工沟通方式普遍推崇越快越好、越简单直接越好,这就要求组织更加扁平化。以往组织的任务是发号施令式的,现在可能会有更多的人可以发令,但这往往是个倡议,是否有人响应,如何响应,之后任务如何执行落实?这不仅需要更系统的流程支持,也需要重构与之相应的组织文化。

再来看价值观管理方面。借助移动设备和社交网络,员工获取信息渠道增多、信息传递更快,比如对于公众事件,员工掌握的信息可能比组织更全面,一改过往组织与个人信息不对称的局面,加上员工对组织内部信息的传递效率、决策流程不了解。久而久之,难免对企业产生误解,引起价值观的冲突事件。比如关于雅安地震后的捐款,一些企业内部出现了不同的声音,一部分员工认为国难当头,捐款救助乃爱国行为;一部分员工认为是作秀、被媒体绑架、逼捐,不如用这些钱改善员工福利。这时,员工个人价值观与组织价值观之间就产生了冲突。

此外,社交化对雇主形象管理也造成了不小的影响。眼下人人都是自媒体,很多企业担心社交网络干扰和影响员工工作,对社交网络进行排斥,像开心网、人人网等IP地址普遍被禁,QQ等即时通讯软件也常被限制使用。但是,难以完全禁止员工随身携带的移动通讯设备,特别是员工下班之后,如果匿名发表对企业负面信息而引发雇主品牌危机事件是难以控制的。2013年11月微博上曾爆发的咖啡厅面试事件就是一个很好的例证。面试官只是随手发一个微博,但对候选人的过分挑剔成为最大的硬伤,引发无数人对面试官的责骂,貌似提升了企业知名度,但损坏的是其美誉度。

迎合管理社交化

社交化,已经成为不可逆转的潮流,作为HR,不想被绑架,唯有主动出击。

大道至简,回归本质。社交化时代来了,员工个人的价值和声音在放大,面对员工个性化诉求,HR是迎合、追随,还是牵引?最有效的方法可能是最简单的——回归本质,遵从人性、人心。比如,在企业文化建设中,不可能让所有员工完完全全地的认同,那就一如既往地厚爱那些沉默的大多数,也要学会倾听不同的声音,尊重少数人的意见,在满足组织期望和个人需求中,找到多方共赢的或平衡的解决方案。

运筹帷幄,要有格局。虽然不是CEO,但HR也要有开放的视野,对行业有一些前瞻性的判断。比如,在组织架构设计中,既要遵循企业历史基础和现实状况,也可以借鉴同行业标杆企业的组织模式,并在企业适应客户社交化、员工社会化方面预留接口、留有余地。具体到人力资源部门职能设计,一边沿用传统HR模块化的业务管理,也可借鉴HR专家顾问的角色管理,既要尊重历史,更要放眼未来。

精耕细作,从小做起。老子说:“天下难事必作于易,天下大事必作于细。”HR应对社交化的时代变迁亦如此。比如,对企业关键人才跳槽问题,认真去分析其直接原因、间接原因、跳槽方向、跳槽渠道等,接下来要在如何吸引人才、如何留住人才上下足工夫。实际上就是从人力资源“选育用留汰”各个环节的细微处下手,有则改之无则加勉。小事成就大事,细节成就完美。HR就是要从小做起,从细节做起。

如其本来,从我做起。“如其本来”是佛学用语,意思是假设人有一个本来,这个本我是清净明澈的,如其本来就是去伪存真回归本我。面对社会和外界千变万化,唯有以自我不断觉醒、修行,才能以不变应万变。比如,在雇主品牌管理工作中,HR就是一面镜子,在招聘时对候选人要举止得体,对第三方伙伴要有礼有节,与企业员工相处亦是不亢不卑,包括在社交网络各种场合行事谨慎,你可以不说话,但你说的每一句话都可能代表你的职业品质和雇主形象。

来源:HR369

资讯

自由职业市场发展迅猛:Elance-oDesk融资3000万美元,备战IPO

自由职业外包平台Elance-oDesk宣布融资3000万美元,帮助自由职业者和企业雇主更好的进行匹配。本轮融资由现有投资者 Benchmark、以及T. Rowe Price、FirstMark、Sigma West, NEA 、the Stripes Group领投。

去年12月,Elance以及oDesk——自由职业市场两家最大的竞争者宣布合并。不过合并后两家网站保持独立运营。合并后两家公司的自由职业者用户达到1000万,2013年收入为7.5亿美元。

而现在,该公司宣称用户上升为1300万,2014年年收入将达到9亿美元。

Elance-oDesk允许用户发布一些自由职位信息,比如编写代码、设计以及抄写、翻译等。雇主可以在这个平台上挑选自由职业者并支付报酬、他们可以通过Elance-oDesk平台进行交流,Elance-oDesk也会对雇佣情况进行追踪。

根据Elance-oDesk官方数据显示,目前其平台上总共有将近500万个岗位,创造价值为50亿美元以上。每分钟有1.2个岗位通过该平台发布,需求最大的前十大岗位是:网站编程、写作、PHP工程师、HTML工程师、平面设计、网络营销、市场营销、Adobe Phtoshop、行政助理、CSS。

目前在美国,Freelancer 以及远程办公等更加自由的工作方式已经变得平常,也促进了Freelancer、Guru、Elance-oDesk等自由职业网站的快速发展。不过Elance-oDesk CEO Fabio Rosati称:尽管在线工作的趋势不可避免,但目前这种方式占全部工作类型的份额仅为2%-3%。

Benchmark合伙人Kevin Harvey透露Elance-oDesk将于近期IPO,本轮融资将是其IPO之前最后一轮融资。

Elance于1999年成立,已经有15年历史;oDesk成立于2003年,也已经有10年历史。在合并之前,oDesk共计融资4400万美元,Elance共计融资约9000美元。

来源:快鲤鱼

资讯

Dropbox移动应用与微软Office办公套件正式进行整合

本月早些时候,Dropbox与微软共同宣布达成合作协议,微软宣布与Dropbox合作,将其整合至Office。

根据这一协议,Dropbox将向微软Office办公套件提供更好的支持,包括可以从Dropbox移动应用上面直接编辑Office文档。今天,这些整合已正式面向安卓版和iOS版Dropbox应用用户推出。

Dropbox在宣布这一消息的博文中解释说,现在,当Dropbox用户外出时,他们也可以编辑Office文档了:直接从Dropbox应用中进行编辑,然后直接从Office应用中访问。若想使用这些新功能,用户首先必须要将自己的Dropbox应用升级到最新版本,然后打开保存于Dropbox上面的Office文档、电子表格或演示文稿。

随后,一个新的“编辑”图标(见上图)会出现,允许用户切换至新的office移动应用,以便对Office文档作出改动。一旦用户完成这项工作,这些改动会自动在Dropbox进行保存。

Dropbox与微软之间的合作范围广泛,旨在增强两家公司的协作性,此举可能也让不少业内人士吃惊,毕竟两家公司的产品存在竞争。微软具有类似于Dropbox的云计算服务——OneDrive,只不过Dropbox的用户数量更多,达到数亿人,其中还包括8万家企业客户。

正如之前所做的报道,Dropbox与微软在11月初签署的合作协议包括四个部分:用户可以在Dropbox移动应用上快速编辑Office文档;从Office应用访问Dropbox文档;在Office应用中分享Dropbox链接;给微软移动产品开发第一方Dropbox应用。

来源:TechCrunch

资讯

“中国在线教育行业图谱”发布,970个在线教育项目构成了中国在线教育行业的全景图

[摘要]970个在线教育项目构成了现在中国在线教育行业的全景图。

近日,好未来发布了最新版《中国在线教育行业图谱》,围绕“现在何处”(行业解码)、“往何处去”(行业图谱)、“如何到达”(发展趋势)三个模块对在线教育进行解读。以下为详细内容:

1、行业解码:半年在线教育项目投资额达4.7亿美元

自2013年至今,中国在线教育市场披露的投资金额达到9.1亿美元(数据来源:Itjuzi),其中,从2014年5月以来发生的投资金额达4.7亿美元,意味着将近两年来,一半以上的投资金额都发生在近半年。预计在未来几年,中国在线教育市场的年度增长率将达到19%,2015年的市场规模将达到1200亿人民币(数据来源:艾瑞咨询)。

根据《中国在线教育行业图谱》显示,按照客户需求划分,在线教育的创业项目主要涉及11大领域,分别是母婴、学前、少儿外语、中小学、大学/研究生、留学、职业考试、职业技能、成人外语、兴趣、综合,将这11个标签设定为在线教育的“X轴”。

按主营业态划分,可以分为工具、内容、服务3个类型,设定为在线教育的“Y轴”。按电子商务的商业模式划分,可以分为B2B、B2C、B2B2C、C2C、C2B五种,其他不涉及交易过程的项目则被定义为“其他”商业模式,设定为在线教育的“Z轴”,由此,搭建出中国在线教育的行业图谱坐标系,尝试将在线教育项目“对号入座”。

2、行业图谱:中小学、职业技能领域成两大高地

在高达1200亿人民币在线教育市场潜在规模下,970个在线教育项目构成了现在中国在线教育行业的全景图(数据来源:Itjuzi,芥末堆行业数据库),其中半年内成立的新项目达280个,占总量的29%左右,其中中小学教育和职业技能领域较为集中。

进一步剖析后发现,从客户需求角度分析,人才结构性失衡、一系列教育政策的改革、二三线城市家长对课外辅导教育的重视等持续推动教育市场扩大,并致使中小学,职业技能成为创业和投资的热门领域。同时由于创业项目的方向与刚需变化方向基本吻合,此趋势可能还将继续。

从主营业务类型分析,现在分为工具、内容、服务等三大领域,其中,服务类项目吸引了2013年以来45%的私募投资金额(不包含IPO),且半年来,服务类项目数量增加了90%。这也与由工具产生内容(Content)、内容吸引用户形成社区(Community)、最终转化为对内容和服务收费(Commerce)的发展路径相吻合。

从商业模式分析后发现,B2C依然是现阶段的创业和投资热点,但是B2B与C2C类项目也开始崭露头角。在其他领域蓬勃发展的P2P生态(C2C的一种模式)也带给在线教育行业启示,当教育内容/产品及客户的评价体系更加标准化,基于碎片化学习产生更多的实时性的学习需求后,在线教育或将出现更多“人人为师,人人自学”的P2P模式型的项目。

在未来,新的人机交互模式、人工智能和游戏化设计等正在重构学习的过程和体验。人机交互模式可以构建良好的用户体验,游戏化可以提升用户的学习动机,而人工智能,更多的是通过数据挖掘的方式,支持个性化学习。

3、发展趋势:突出重围的四种办法

如何在在线教育市场持续成长?

第一,原地扩张。在坐标不变的情况下,将产品或服务的标准化和运营做到极致。因为,只有产品和服务的极致化,才能更好地满足用户的需求,满足用户的痛点。

第二,从单一型产品扩张到复合型产品。比如从工具型产品开始,未来延伸到内容或服务领域,实现自身商业模式的闭环。

第三,Z轴的延伸,结合优势,定位供应链,通过最适合自己的商业模式发展自身优势。

第四,X轴的延伸,新客群扩张,例如底层的通用技术类产品,在技术形态基本不变的情况下,可以通过内容的转换,快速实现各个品类的扩张。

来源:腾讯科技

资讯

69%的澳大利亚人醒后第一件事是查看移动设备,那么你呢?

据澳洲网报道,澳大利亚人的生活越来越离不开各式各样的电子产品,电子产品已渗透至人们生活的各个方面。但即便如此,据市场调研公司EY于24日公布的最新调查,仍有很多澳大利亚人认为相比其他国家,他们在电子产品的使用方面很落后。

报道称,EY共对1500名消费者和167名澳大利亚数字领域领军人物进行了调查。结果发现,澳大利亚人对智能产品的“上瘾”程度处于极高水平。

其中,69%受访者自称早上醒来第一件事就是查看手机或平板电脑等电子产品,46%表示手机等电子产品改善了生活质量,让他们更加快乐;40%称电子产品提高了他们的工作效率;50%认为电子产品提高了他们的自控能力;64%承认在使用电子产品时还在从事其他工作;75%认为自己的生活已离不开诸如谷歌等各种搜索引擎。不过,20%受访者认为电子产品的使用已影响到他们的睡眠。

调查还显示,消费者认为娱乐、电视、电影及媒体类网站能够提供最佳上网体验,而政府及公共服务类网站的上网体验最差。而个人隐私及安全为消费者使用电子产品时最为担忧的问题。调查称,80%受访者认为政府应强制网站提高透明度,尤其是在使用个人数据方面。

此外,澳大利亚的数字化发展进程似乎并未得到国人的认可。40%受访者认为澳大利亚数字化的先进程度不及其他发达国家,只有14%受访者认为澳大利亚数字化程度比其他发达国家先进。而对行业领袖的调查显示,59%受访者认为澳大利亚数字化程度落后于其他发达国家,其中67%认为是不够宽松的国家政策导致了这一结果。

RY客户主管珍妮 杨(Jenny Young)表示,社交媒体是澳大利亚人深陷“电子隐”的主要原因之一。她指出,69%澳大利亚人每周都会登陆各类社交网站,其中60%承认曾在上班时登陆社交网站,而“脸谱”(Facebook)依然为澳大利亚人访问量最高的社交网站。

自中新网

资讯

掌握不了这五门技术 你马上就会过时

[摘要]企业将依赖数字营销、电商、客户体验管理、业务分析以及云业务提高公司表现。

分析公司Gartner 2014年CEO和高管调查显示,在今后五年内,CEO们在很大程度上依赖数字营销、电子商务、客户体验管理、业务分析以及云业务提高公司表现,它们有望成为CEO以及高管们眼中最具商业价值的投资技术领域。

这份报告名为“2014年CEO和高管调查:风险偏好将加速数字业务”(‘Risk-On’ Attitudes Will Accelerate Digital Business),由Gartner副总裁兼研究院士马克·拉斯金诺(Mark Raskino)执笔,为这些投资领域提供额外见解。去年的调查报告也是拉斯金诺联合执笔的。

下列图表则是Gartner副总裁、著名分析师蒂芙尼·博瓦(Tiffani Bova)发布的,可以让人轻松了解到2014年到2019年间最热门的技术投资领域。这幅图中显示,“以客户为中心”不再是一句口号,而是正成为必须实行的标准。

这五大技术领域的商业价值获得最高投资期望可以理解,因为它们共同促使企业吸引和维护客户。此外,它们可以为CEO以及高管们提供更精确的观点,让后者了解他们的销售和服务战略如何能吸引新客户,同时能够挽留住老客户。

对于CEO们来说,现在是时候超越重复高喊“以客户为中心”口号的时候了,他们需要采取大胆的必要步骤去实现这个口号。而利用上述五大热门技术投资领域,CEO们可以帮助公司实现真正的“以客户为中心”,向他们提供更好的服务。

这五个最具投资价值的技术领域将成为催化剂,清除内部障碍,统一多样性的销售、服务以及渠道,从而提供更好的客户体验。(风帆)

来源:腾讯科技

扫一扫 加微信

hrtechchina

资讯

资讯

资讯

资讯

资讯

资讯

资讯

资讯

资讯

资讯

资讯

资讯

资讯

资讯

资讯

资讯

资讯

资讯

资讯

资讯

扫一扫 加微信

hrtechchina

扫一扫 加微信

hrtechchina